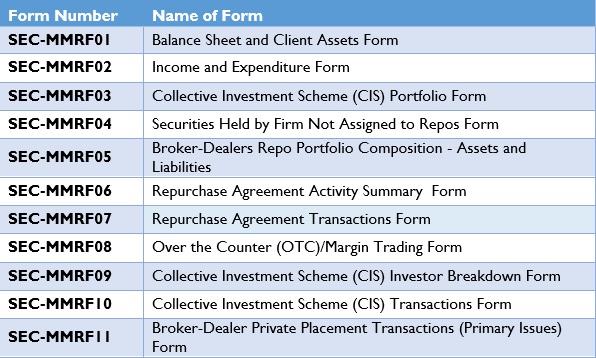

The Trinidad and Tobago Securities and Exchange Commission’s Micro and Macro-Prudential Reporting Framework (MMRF) will capture financial and statistical data from registrants through the use of several forms.

The data collected will allow the Commission to analyze and evaluate the health, soundness, and potential vulnerabilities of the securities market, as it will inform key micro and macro, prudential and financial soundness indicators, for all segments of the securities market (securities, mutual funds, repos, etc.)

The data we are requesting is to be provided by persons registered under Sections 36 and 51(1) of the Securities Act 2012, i.e. self-regulatory organisations, broker-dealers, investment advisers and underwriters. With the introduction of these new Forms, as per Order of the Commission dated 1st September 2016 (http://ttsec.org.tt/wp-content/uploads/MMRF-Order.pdf), registrants will be asked to submit the relevant information to the Commission.

Please note the following:

- MMRF submissions are due on the last working day of the month following the end of each quarter. The platform will be available for uploading data from the first day following the end of each quarter. In the event of any disruption with the Submissions Platform , such information will be communicated to registrants, at the earliest time.

- Failure to make the required submissions is a breach of the Commission’s Order and subject to administrative fines up to a maximum of five hundred thousand dollars in accordance with sections 156(1) and 165(2) of the Securities Act, 2012.

- In completing the forms, registrants are required to use the most recent version of the MMRF forms and instructions, which can be found under the section \”MMRF Forms\” enclosed below. Please do not copy and paste from previous submissions where older versions of the forms were utilized;

- Please ensure the accuracy of all submissions and re-submissions as there continue to be errors in re-submissions, notwithstanding identification of such errors in previous communications; when making re-submissions, ensure that you follow the instructions as requested, as any deviation in the required format of the data renders it useless for our purposes, e.g. if submitting data for March 2016, please ensure that this drop-down box is selected and not March 2017 or vice versa;

- Kindly pay close attention to the classification of assets in forms MMRF03, MMRF04 and MMRF05. Guidance on classifications can be found in the \”Instructions\” and \”MMRF – Categorization of State Agencies – Appendix 1\” documents enclosed below under the section \”MMRF Forms\”.

- You will be advised of any additional changes made to forms and the period from which submissions will be required using the revised form(s).

- You are reminded that effective August 23, 2017, submissions/re-submissions of forms will only be accepted using Excel 2013 or higher. Submissions using earlier versions of Excel will be rejected by the platform and will be regarded as a failure to submit.

Additionally, please be reminded of your responsibility to ensure that the profile information for the primary and alternate contacts are always up to date. Any changes to this information must be reported to mmrf@ttsec.org.tt.

These submissions are part of your ongoing reporting requirements and we look forward to your continued cooperation in this regard.

Email comments, questions or concerns to: mmrf@ttsec.org.tt.

Staff Comments

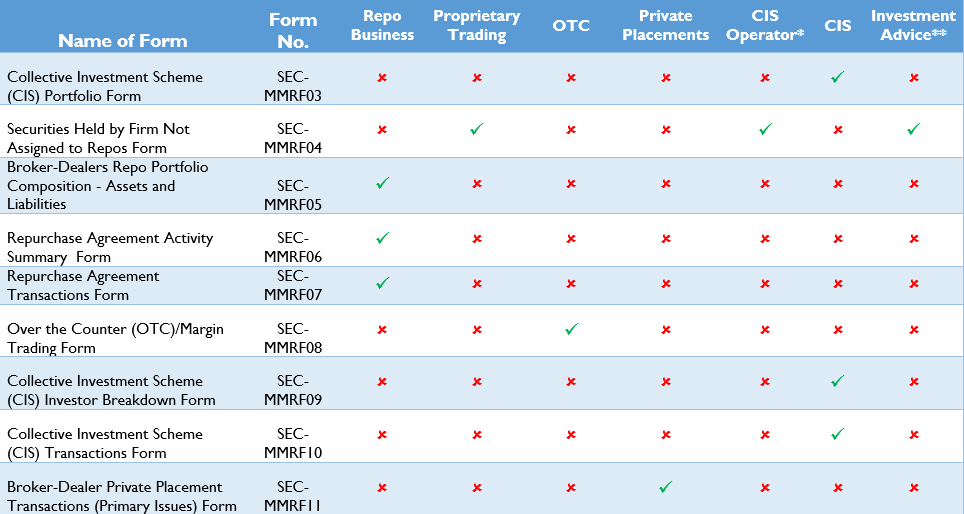

*For Broker-Dealers that are investment managers of CISs, the SEC-MMRF01 and SEC-MMRF02 must be completed for the investment manager itself as well as for each CIS that it manage.

** For an Investment Adviser who has a proprietary book, the SEC-MMRF04 must also be completed.

Please be advised that the MMRF Forms have been updated effective 05th August 2025. Registrants are required to complete only those forms in the MMRF Workbook that relate to their business activity as illustrated in the tables above.

Each reporting entity is required to complete the coversheet, which captures general information on registrants and collective investment schemes (“CISs”).

This is a statement of the assets, liabilities and capital of a registrant at a particular point in time. For a CIS issuing different classes of units, a separate Balance Sheet must be completed and submitted for each class.

This form will capture information on the income and expenditure of registrants. For a CIS issuing different classes of units, a separate Income Statement must be completed and submitted for each class.

This form aims to capture the name, holdings, price and market value of each financial asset held on the CIS portfolio for which this report pertains. For a CIS issuing different classes of units, a separate CIS Portfolio Composition form must be completed and submitted for each class.

This form captures information on all securities held by a Broker Dealer that have not been used as collateral for either a Repurchase Agreement or Repurchase Agreements for the purpose of assessing the overall risk exposure of the registrant.

This form collects information on the securities assigned to the repo portfolio and the category of each repo client. “Repo” means a “Repurchase Agreement” which is the sale of a security with a commitment by the Seller to buy the same or equivalent security back from the Purchaser at a specified price and at a designated date in the future.

This form collects information on the number of Repo contracts a registrant has in issue and the value of total repo obligations categorised by currency.

This form collects information on the repo agreements entered into during the reporting period by a repo seller.

This form collects information on OTC transactions where a registrant acted as agent (arranger) or principal (buyer/seller). For the purposes of the form, an OTC transaction includes any trade not occurring on a securities or stock exchange.

This form collects information on the type of investors in a CIS as at the end of the reporting period. For a CIS issuing different classes of units, a separate CIS Investor Breakdown form must be completed and submitted for each class.

This form collects information on the transactions carried out by a CIS during the reporting period. For a CIS issuing different classes of units, a separate CIS Transaction Form must be completed and submitted for each class.

The purpose of this form is to capture information on all primary issues of securities that do not trigger the registration requirements of section 62(1) of the Securities Act, 2012 and arranged by the Broker-Dealer for financing.