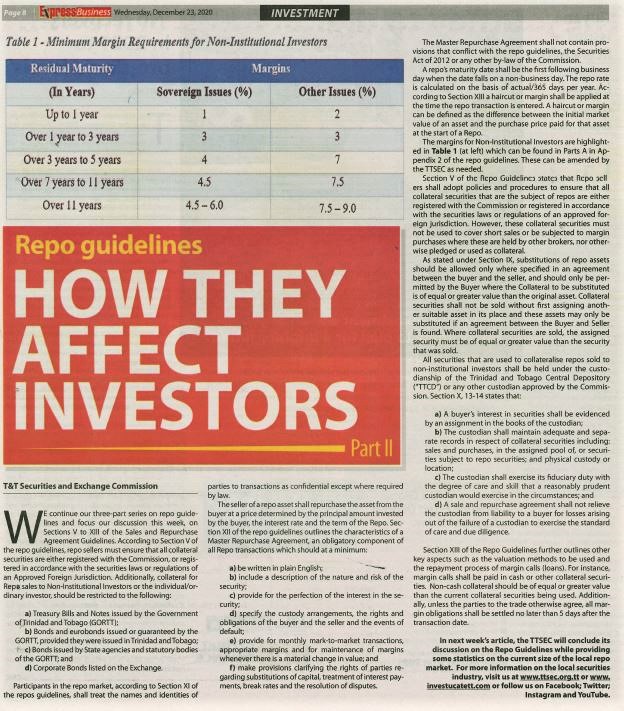

We continue our three-part series on Repo Guidelines and focus our discussion this week, on Sections V to XIII of the Sales and Repurchase Agreement Guidelines. According to Section V of the Repo Guidelines, Repo sellers must ensure that all collateral securities[1] are either registered with the Commission, or registered in accordance with the securities laws or regulations of an Approved Foreign Jurisdiction. Additionally, collateral for Repo sales to Non-Institutional Investors or the individual/ordinary investor, should be restricted to the following:

- Treasury Bills and Notes issued by the Government of Trinidad and Tobago (“GORTT”);

- Bonds and Eurobonds issued or guaranteed by the GORTT, provided they were issued in Trinidad and Tobago;

- Bonds issued by state agencies and statutory bodies of the GORTT; and

- Corporate Bonds listed on the Exchange.

Read more here:

Repo Guidelines How They Affect Investors -Part 2