Collective Investment Schemes (“CIS”), commonly known as mutual funds are investment vehicles, which allow the pooling of investor resources to create a more diversified portfolio and take advantage of the benefits of large-scale investment opportunities. Investors effectively own portions of the overall pool through units/shares, which are proportional to their contributions. The mutual fund manager, the entity responsible for managing the fund, utilises the pool of money to invest in securities in line with the fund’s investment strategy. Investors can earn returns through distributions or capital appreciation depending on the fund’s performance.

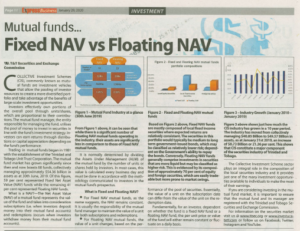

Read more here—>Â Fixed NAV v Floating NAV