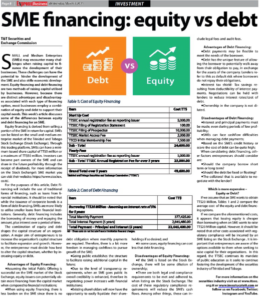

Small and Medium Enterprises (SMEs) may encounter many challenges when raising capital to finance the development of their businesses. These challenges can have the potential to  hinder the development of the SME and also stifle economic development. Equity financing and debt financing are two (2) methods of raising capital utilised by businesses. However, because there are distinct advantages and disadvantages associated with each type of financing option, most businesses employ a combination of equity and debt to support their capital needs. This week’s article discusses some of the differences between equity and debt financing for an SME.

SME Financing – Equity Vs. Debt