TTSEC: Interim Operational Changes in Response to COVID-19

The Trinidad and Tobago Securities and Exchange Commission (“the Commission”) remains committed to protecting the health and safety of Staff, […]

The Trinidad and Tobago Securities and Exchange Commission (“the Commission”) remains committed to protecting the health and safety of Staff, […]

The public is advised that the Trinidad and Tobago Securities and Exchange Commission (“the Commission”) is seeking to ensure a

Effective March 23, 2020 Customer Service Protocol Registrants and Visitors to the Commission will be now be required to complete

On February 3, 2020, China’s financial sector recorded one of its worst days, with equities decreasing as much as 9.1

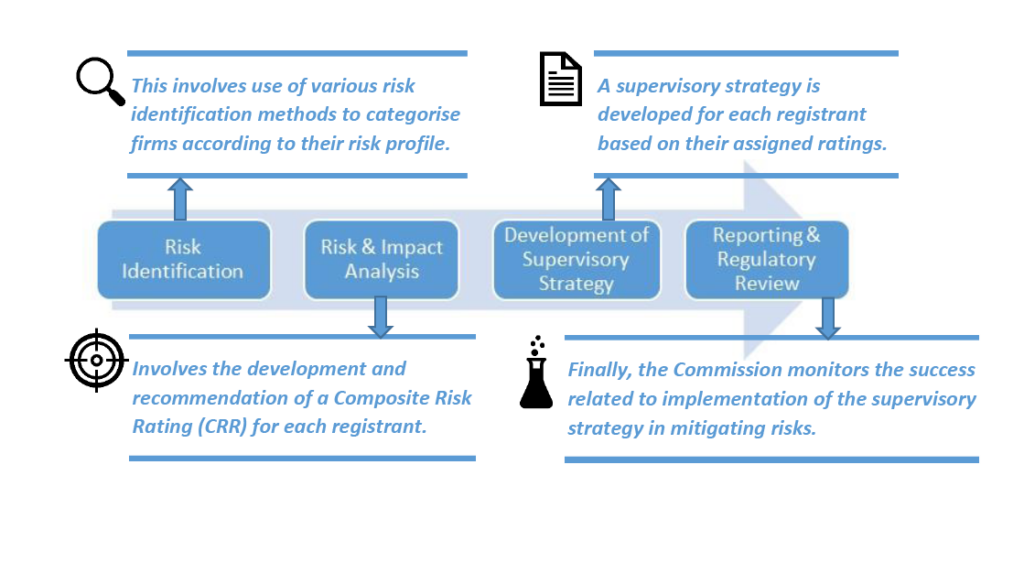

Financial regulators globally previously utilised traditional supervisory approaches to market regulation which focused on a Rules-Based System of control. This

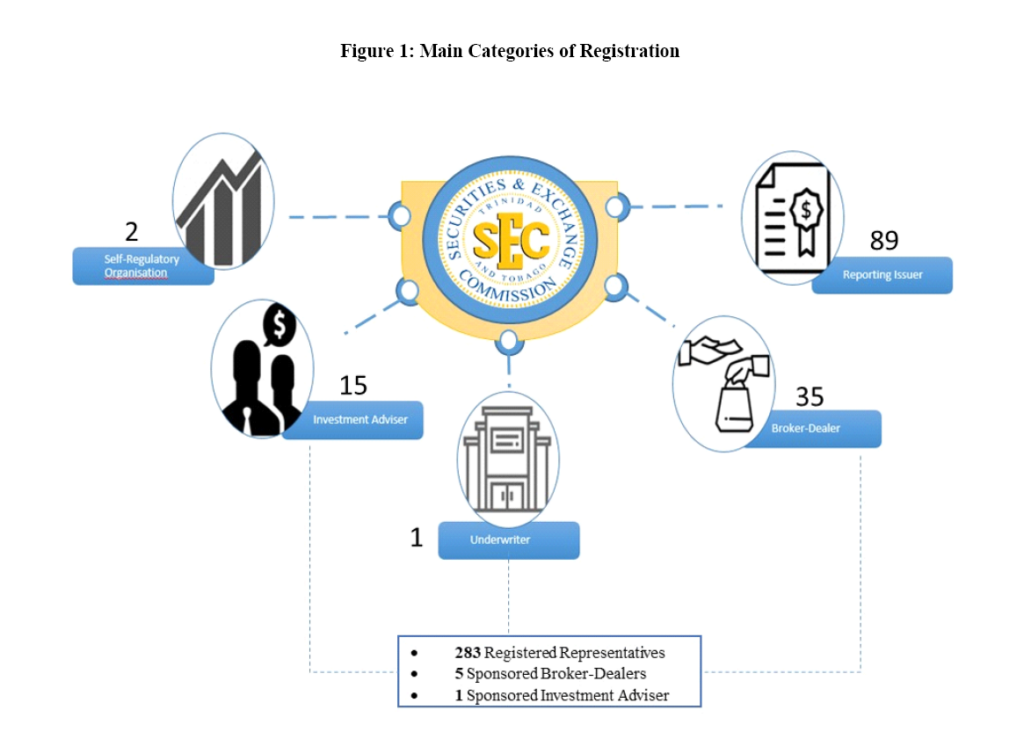

Registrants of the Trinidad and Tobago Securities and Exchange Commission (TTSEC) play an important role in the development and stability

PUBLIC STATEMENT OF THE TRINIDAD AND TOBAGO SECURITIES AND EXCHANGE COMMISSION FREEDOM OF INFORMATION ACT 1999 CHAPTER 22:02 (FOIA) In

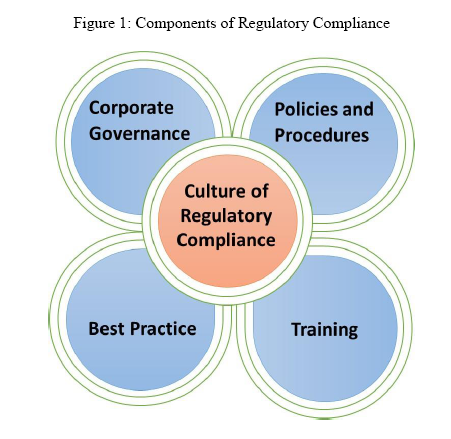

As the regulator for the securities industry, establishing regulatory compliance requires continuous vigilance and resources. Simultaneously, as our regulatory demands

Regulatory compliance is essential to the orderly functioning of the securities market. Registrants registered with the Commission should establish effective

Entities that engage in activities specified within the respective legislation that govern the TTSEC and the CBTT are required to